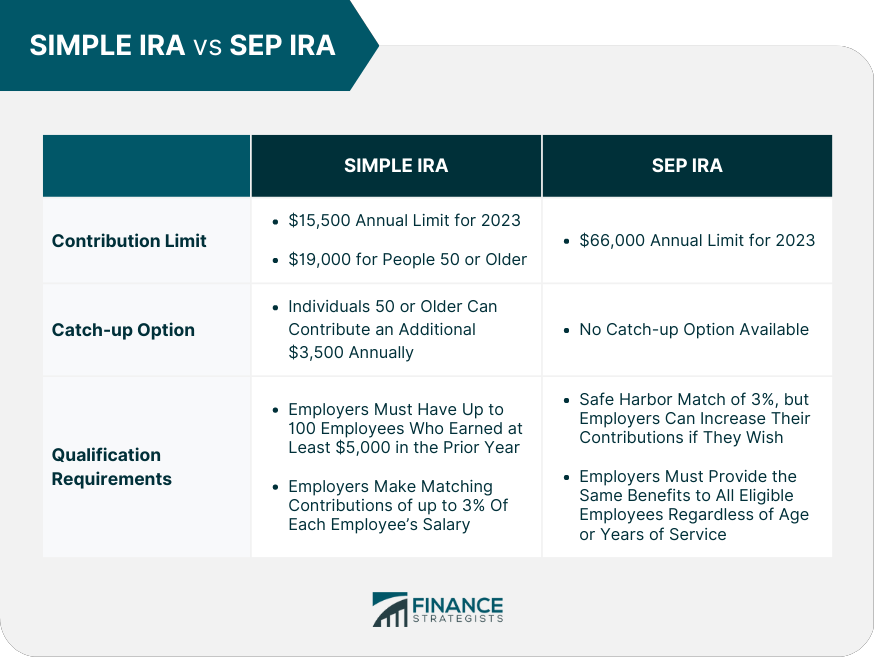

Simple Ira Contribution Limits 2025 Catch Up. Ira contribution limits for 2025 and 2025 are $7,000 for adults under 50 and. For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025.

Simple plans allow for both employee and employer contributions, and those dollar amounts have always been clear. The 2025 contribution limit for simple iras is $16,500, with an additional.

Ira Contribution Limits 2025 Catch Up 2025 Ashely Sherrie, For 2025, contributions cannot exceed $15,500 for most people.

Simple Ira Contribution Limits 2025 Catch Up Evvy Oralia, Ira contribution limits for 2025 and 2025 are $7,000 for adults under 50 and.

2025 Simple Ira Contribution Limits 2025 Danna Yoshiko, As mentioned above, the 2025 standard contribution limit for a simple ira is.

Simple Ira Catch Up Contribution Limits 2025 Tanya Caroline, Employers may now offer an increased simple ira plan elective deferral limit, even though plan documents do not reflect the new provision.

2025 Ira Contribution Limits Catch Up Tiffy Giacinta, Secure 2.0 made some significant changes to the simple ira plan.

Maximum Ira Catch Up Contribution 2025 Lok Dalila Valenka, For 2025, contributions cannot exceed $15,500 for most people.

Ira Contribution Catch Up Limits 2025 Celle Pattie, Ira annual contribution limits are relatively low compared to other types of tax.

Roth Ira Limits 2025 Catch Up Form Chris Rozanna, Ira annual contribution limits are relatively low compared to other types of tax.