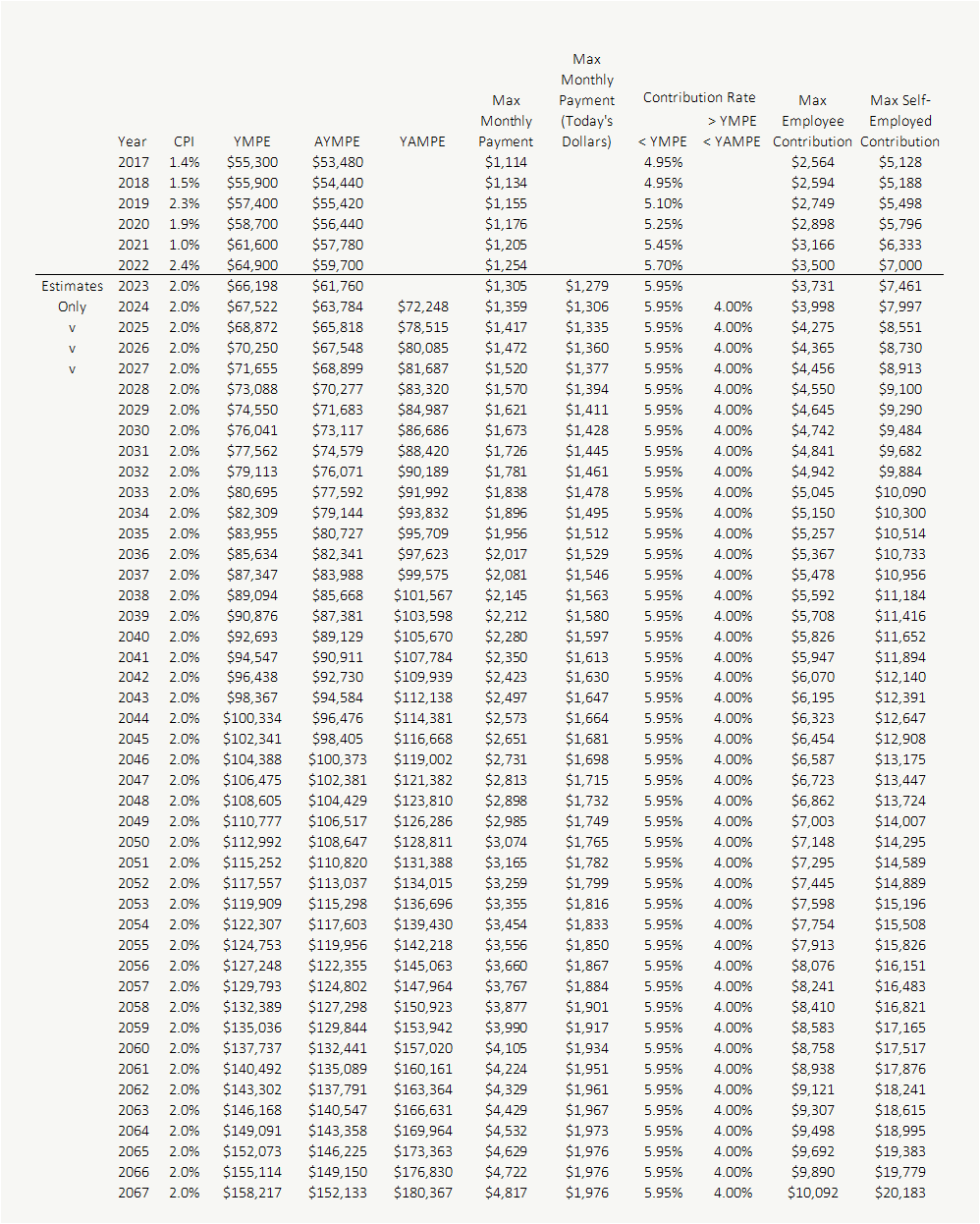

Cpp Contributions For 2025. The contribution rates and amounts for cpp and cpp2 in 2025 are as follows: The cpp enhancement will increase the amount working canadians receive in the cpp.

When you do your taxes, your cpp contributions must be separated into two parts: For 2025, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2025 was a much lower $758.32 per month.

You can find out how much you’re on track to receive from cpp using the canadian retirement income calculator.

CPP Payments in 2025 What You Need To Know, The cpp enhancement will increase the amount working canadians receive in the cpp. Cpp base alongside first additional cpp contributions and cpp2 contributions.

Canada Pension Plan Payment Dates How Much CPP Will You Get This Year, How second additional cpp contributions are calculated; Your 2 contributory periods for the cpp enhancement also.

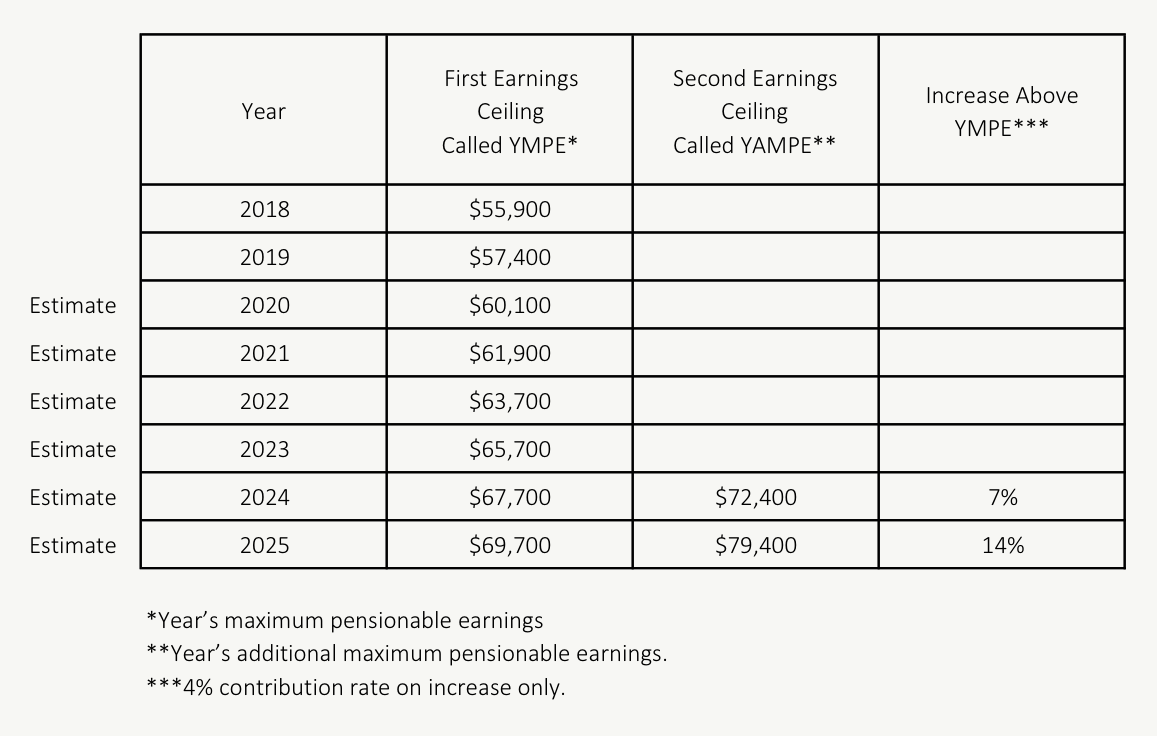

A Complete Guide to the Canada Pension Plan, How second additional cpp contributions are calculated; The maximum limit of earnings protected by the cpp will also increase by 14% between 2025 and 2025.

Canada Pension Plan (CPP) Is Expanding! And That’s Going To Make, Your contributory period for the base cpp begins when you reach age 18 (or january 1, 1966, whichever is later). If you are an employee, you and your employer will each have to contribute 5.95% of your.

Get ready for even higher CPP premiums 2025 2025 r, The basic exemption amount for 2025 remains at $3,500. When you do your taxes, your cpp contributions must be separated into two parts:

Understanding the New Canada Pension Plan (CPP) Contributions What You, For 2025, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2025 was a much lower $758.32 per month. When you do your taxes, your cpp contributions must be separated into two parts:

CPF Contribution Rates and AIS Metropolitan Management Services Pte Ltd, For 2025, that means a maximum $188 in additional payroll deductions. How second additional cpp contributions are calculated;

CPP contribution rates and the maximum contribution amounts (curent, Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in 2025. Your contributory period for the base cpp begins when you reach age 18 (or january 1, 1966, whichever is later).

Significant HSA Contribution Limit Increase for 2025, Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in 2025. For 2025, that means a maximum $188 in additional payroll deductions.

Cpp application Fill out & sign online DocHub, The basic exemption amount for 2025 remains at $3,500. The maximum limit of earnings protected by the cpp will also increase by 14% between 2025 and 2025.

Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in 2025.